- 408-924-7560

- mineta-institute@sjsu.edu

- Donate

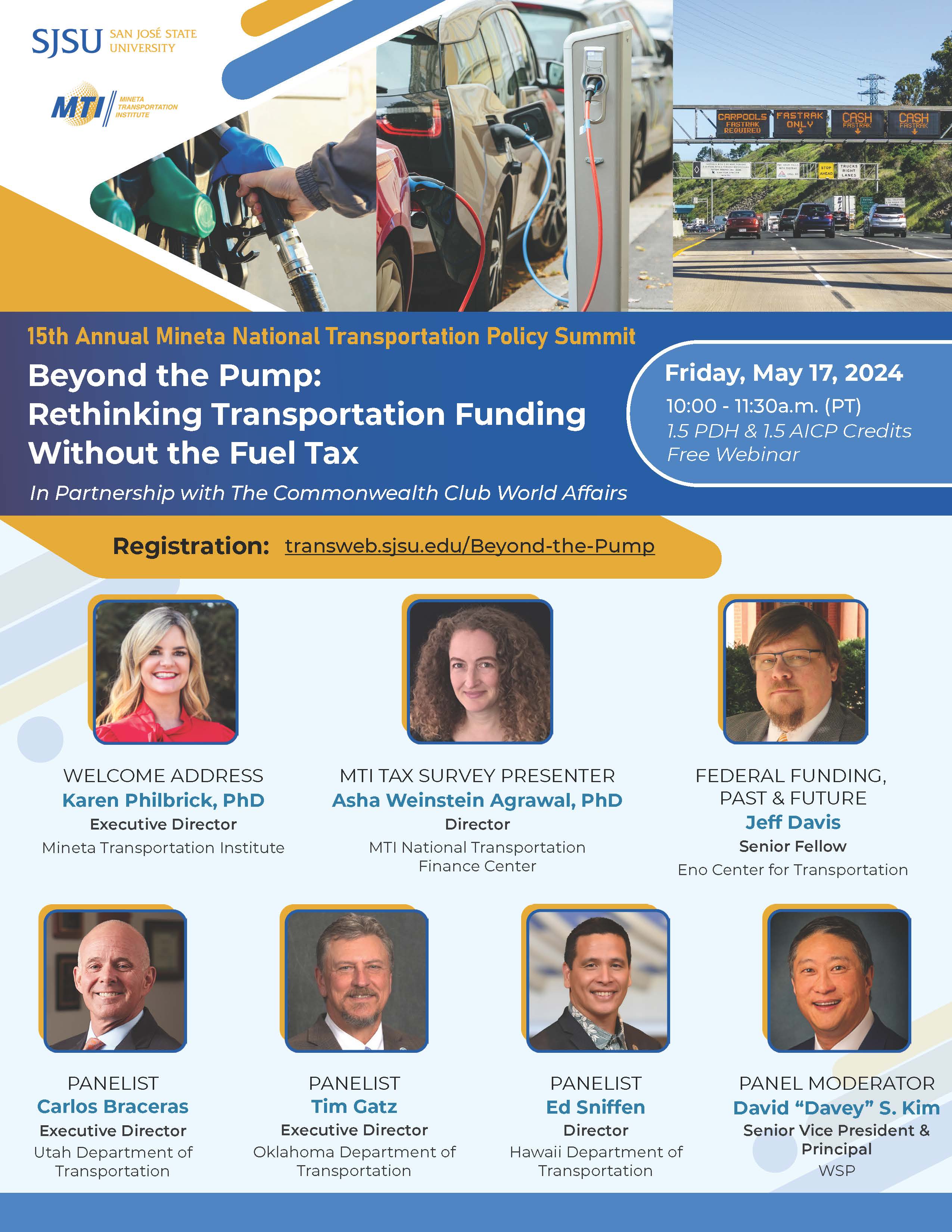

Beyond the Pump: Rethinking Transportation Funding Without the Fuel Tax

15th Annual Mineta National Transportation Policy Summit

10:00 - 11:30a.m. (PT) | Link to Register.

While the climate benefits from booming electric vehicle sales, the nation’s transportation system faces an unfortunate predicament: less gasoline and diesel purchased means dwindling fuel tax revenue. Fuel tax revenue provides a core funding source for operating, maintaining, and improving transportation systems, so policymakers must find a replacement as soon as possible. This event explores such options as mileage fees, higher annual vehicle fees, or abandoning the user-pay principle and relying on general fund revenue.

See here for more information and recordings from past events in the series.

1.5 PDH credits and 1.5 CM credits available to attendees.

View Program

View Recording

View & Download PDH Credit

CM Credit

| MC | MTI Tax Survey Presenter | Federal Funding, Past and Future | Panel Moderator |

|

|

|

|

|

Executive Director

Mineta Transportation Institute

|

Director

MTI National Transportation Finance Center

|

Senior Fellow

Eno Center for Transportation

|

MTI Trustee Senior Vice President & Principal, National Transportation Policy and Multimodal Strategy

WSP

|

| Panelist | Panelist | Panelist |

|

|

|

|

Executive Director

Utah Department of Transportation

|

Executive Director

Oklahoma Department of Transportation

|

Director

Hawaii Department of Transportation

|

-

Contact Us

San José State University One Washington Square, San Jose, CA 95192 Phone: 408-924-7560 Email: mineta-institute@sjsu.edu