- 408-924-7560

- mineta-institute@sjsu.edu

- Donate

Support for Raising the Federal Gas Tax Has Risen Steadily Since 2010

The Mineta Transportation Institute has released its tenth annual survey exploring public support for raising federal transportation revenues through gas taxes of mileage fees:What Do Americans Think about Federal Tax Options to Support Transportation? Results from Year Ten of a National Survey.

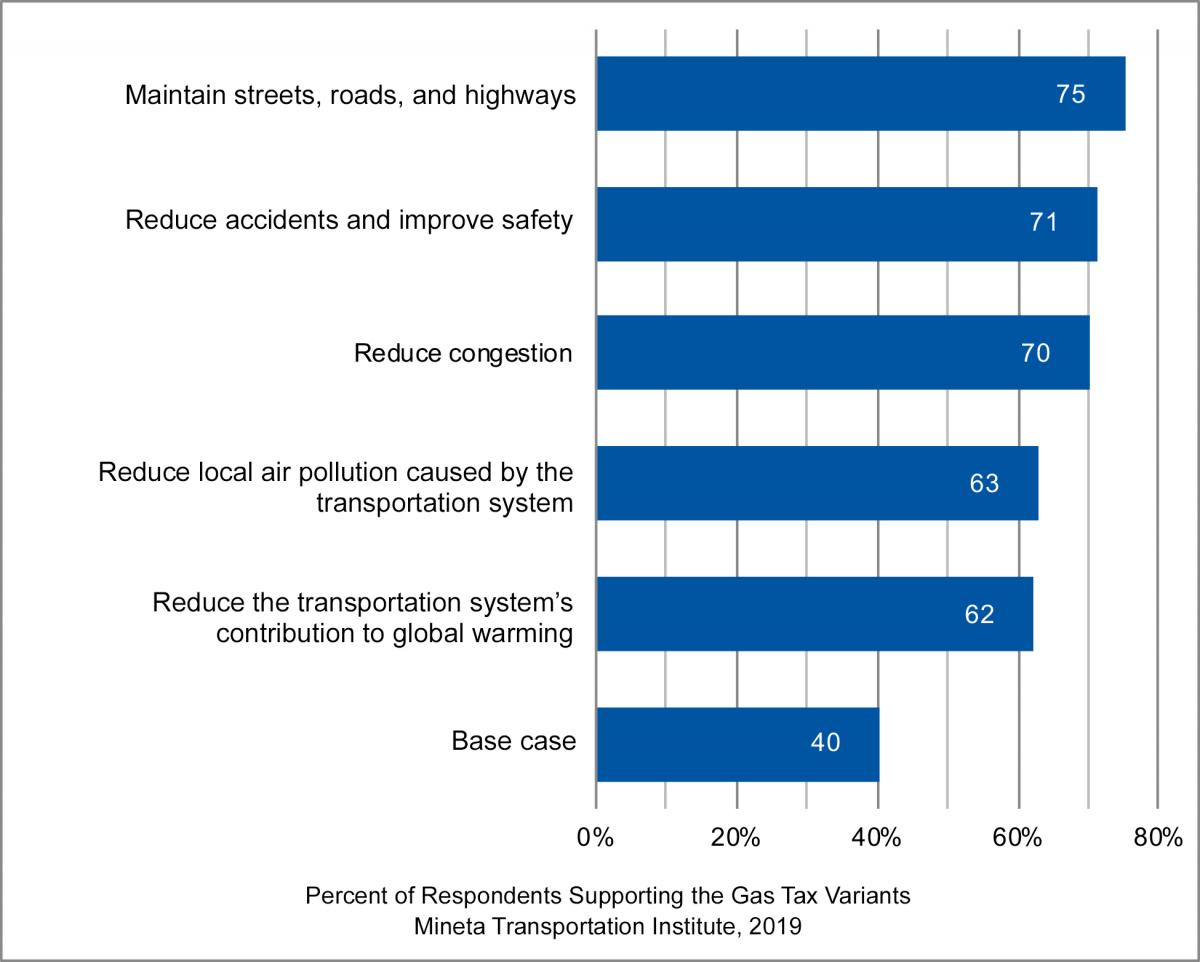

“Support for raising the gas tax is largely dependent on how the revenue will be spent,” says Dr. Asha Weinstein Agrawal, one of the study’s authors and Director of MTI’s National Transportation Finance Center. “Seventy-five percent of respondents supported a 10¢ increase in the gas tax if the revenue raised is dedicated to maintenance projects, but only 40% support the same increase if the money is used more generally to maintain and improve the transportation system.” (See Figure.)

Five of the same gas tax options have been tested each year to assess trends. Study co-author Dr. Hilary Nixon notes that in every case support has risen since 2010, with an increase for each of 13 percentage points or more.

Other key 2019 findings include:

- Large majorities value transportation improvements across transportation modes, including spending gas tax revenue for road and public-transit-related projects.

- People do not have an accurate understanding of how much they pay in federal gas taxes. For example, 19% of respondents thought the federal gas tax rate is at least 76¢ per gallon, far higher than the current rate of 18.4¢ per gallon.

- People would prefer to pay a mileage fee each time they buy fuel or charge an electric vehicle, rather than being billed monthly or annually.

- People hold nuanced views on mileage fees with respect to equity and privacy

- Linking transportation taxes to environmental objectives can increase support.

“We face growing needs across our transportation system, but funding hasn’t kept pace,” says Dr. Agrawal. “To solve this dilemma, we must either lower our goals for system maintenance and improvements, or raise new revenues.”

ABOUT THE MINETA TRANSPORTATION INSTITUTE

At the Mineta Transportation Institute (MTI) at San Jose State University (SJSU) our mission is to increase mobility for all by improving the safety, efficiency, accessibility, and convenience of our nation's’ transportation system. Through research, education, workforce development and technology transfer, we help create a connected world. MTI was founded in 1991 and is funded through the US Departments of Transportation and Homeland Security, the California Department of Transportation, and public and private grants. MTI is affiliated with SJSU’s Lucas College and Graduate School of Business.

ABOUT THE AUTHORS

Asha Weinstein Agrawal, PhD, is Director of the Mineta Transportation Institute’s National Transportation Finance Center. Hilary Nixon, PhD, is Deputy Executive Director of the Mineta Transportation Institute.

###

Contact:

Irma Garcia, MTI Communications & Workforce Development Coordinator

408.924.7560

-

Contact Us

SJSU Research Foundation 210 N. 4th Street, 4th Floor, San Jose, CA 95112 Phone: 408-924-7560 Email: mineta-institute@sjsu.edu